GET STARTED! OKAY, BUT AS WHAT?[:]

Hello everyone!

So I know the title may seem a little wild, put that way, but this marks the end of our business articles! It was also very inspiring for me to read your comments and to see what you were interested in during business week! This article is kinda like the Sistine Chapel, written with the help of our amazing certified public accountant, whose contact information is listed at the end of the article.

I promise, I tried to make it as easy to understand as possible, you’ll see that it’s almost fun! Everything’s going to be okay, really. The more I read this over, the more I think that we couldn’t be clearer.

When you get started, you must know one thing: are you going to sell products (also called trading), or are you going to sell a service? It’s great when you know, but you can do both. You just have to know more or less which one will bring in the most money in order to determine your main activity (APE: activité principale exercée), and to know which collective you belong to, if you plan on having employees.

Paperwork...

So let’s say you decide to open up a pastry shop. You’ll be making sales, but on Saturdays you’ll also be teaching kids’ cooking classes, a service... the main part of your business will come from sales, so your main activity is ‘pastry sales’.

Another thing to note is that there are three legal choices you can choose from:

It’s important to note that when you’re self employed or a sole proprietor, there is no distinction between you and your business.

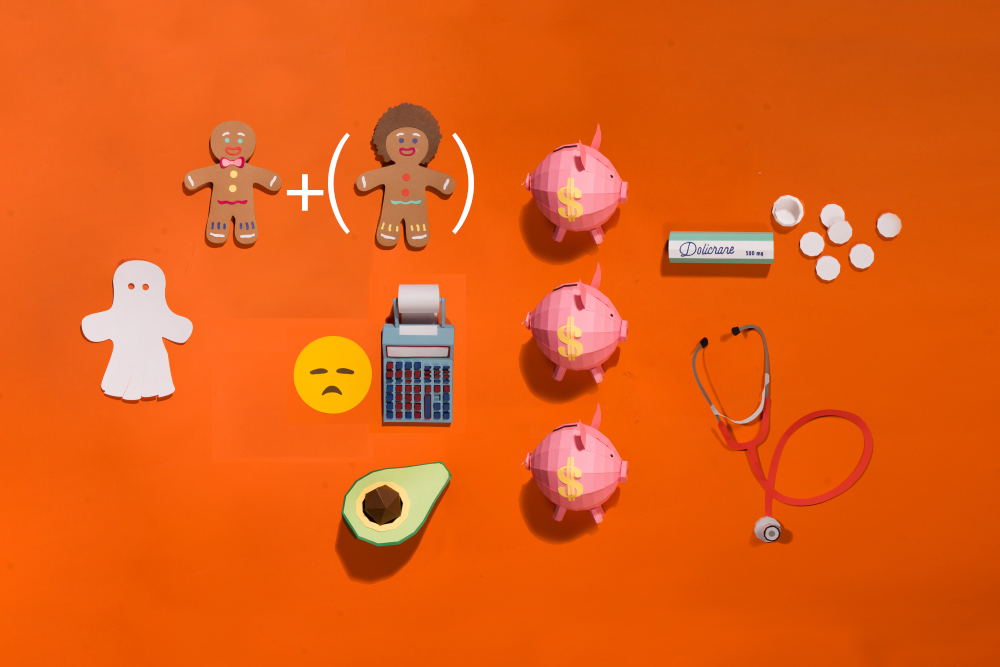

Businesses’ responsibilities on the other hand are limited to the injected capital. Your business is entirely separate. Congratulations on your newborn! Your business is therefore a legal entity, that doesn’t exist. Like a ghost!

Self employment: It’s perfect for getting started! If you know what you want to do, but you don’t know how serious it is and you don’t have any idea what your sales revenues might be, the easiest option is to start off self employed.

- super simple accounting

- no value added tax

- little paperwork, everything is done online

- it doesn’t cost you anything, but for the past couple of years it’s been mandatory to have a second bank account to collect your income

- you’re considered as a self employed person (TNS: travailleur non salarié), you contribute to the RSI/URSSAF depending on your activity (merchant, artisan, advice)

Sole proprietorship comes after being self employed (AE: auto entrepreneur). I’d even say that once you’ve reached the limit of 32,900 euros, sole proprietorship (EI: entreprise individuelle) is fantastic if you’re on your own. This means that you don’t have partners, but you may have employees. This is great for when your business has been doing well for a while and you’ve got a good idea of your goals and what you can accomplish. To go from self employment to sole proprietorship, you’ll need to see an expert (Tylenol is recommend).

Sole proprietorship comes after being self employed (AE: auto entrepreneur). I’d even say that once you’ve reached the limit of 32,900 euros, sole proprietorship (EI: entreprise individuelle) is fantastic if you’re on your own. This means that you don’t have partners, but you may have employees. This is great for when your business has been doing well for a while and you’ve got a good idea of your goals and what you can accomplish. To go from self employment to sole proprietorship, you’ll need to see an expert (Tylenol is recommend).

Sole proprietorship is commonly used for small businesses where there typically is no other partner, or liberal professions such as doctors, lawyers, and artisans...

- this doesn’t cost you any more money, but you must open a professional business account

- more URSSAF or value added tax paperwork

- subject to value added tax

- slightly more complicated accounting (we highly recommend seeing a certified public accountant)

- As a business owner, you’re considered a self employed person (TNS: travailleur non salarié). You contribute to the RSI/URSSAF depending on your activity (merchant, artisan, advice).

- Taxes are however calculated based on your revenues minus your actual charges, unlike a self employed person.

A business will make your activity more credible, especially when you work with other businesses, and it will give you the option to partner with other people. Ask your certified public accountant about any financial aid you may receive. You’ll need a lawyer in order to set up the business status, depending on it’s complexity.

If you wish to partner with a third party, as famous ‘associates’, you’ll need to decide between SARL or SAS, not self employment or sole proprietorship.

A business will make your activity more credible, especially when you work with other businesses, and it will give you the option to partner with other people. Ask your certified public accountant about any financial aid you may receive. You’ll need a lawyer in order to set up the business status, depending on it’s complexity.

If you wish to partner with a third party, as famous ‘associates’, you’ll need to decide between SARL or SAS, not self employment or sole proprietorship.

- accounting is more complicated, you’ll need a certified public accountant

- subject to value added tax

- URSSAF and value added tax paperwork, but no more than sole proprietorship (EI)

- it will cost more money: to pay a director, a certified public accountant, and possibly a lawyer

- While having a business (SARL/EURL/SAS) you’ll be considered self employed (TNS). You’ll contribute to the RSI/URSSAF if you have a SARL or a EURL. However, with a SAS you won’t be self employed, you’ll be an employee and it may be more expensive, ask an expert!

Then there are lots of other little things to know, like if you can get employment bonuses. There’s an arrangement that allows 4,000 euros for the first employee with a permanent contract, and it’s still available in 2017! In other good news, the ‘ARE: aide au retour à l’emploi’ (return to work aid) allows you to receive unemployment benefits if you were employed and you left your job through a contractual termination for example. The arrangement allows you to keep your unemployment benefits for the rest of their duration, so if you start a EURL/SAS/SARL/SAS business, you may not pay yourself via the business until the end of your rights. It’s a great aid when starting your business!

Thank you to Nicolas Barnet, from Batt&Associés for his expert advice and time!

I know that it’s scary, but honestly all these social/accounting/legal questions are much more manageable with people who answer them for their living. I also recommend reading this website and taking notes, it’s very educational! Or directly on the government website here. If it’s all still gibberish to you at the end of this article, see an accountant. Surrounding yourself with the right people is important! The energy you’ll spend trying to do things yourself is energy that you won’t be devoting to bettering your business. Don’t forget: to each their own profession, your accountant is there to make you money, not to lose it!

Translated by Whitney Bolin